greenville county property tax estimator

Please call the assessors office in Greenville before you. Tax Collector Suite 700.

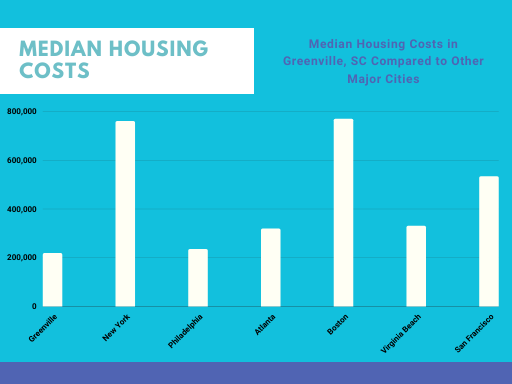

Greenville Sc Cost Of Living Is Greenville Affordable Data

Sales Enter Sheet No.

. Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average. High real property tax rates and rapid property value growth in your community are not legitimate reasons to appeal. The median property tax on a 14810000 house is 155505 in the United States.

The largest tax in Greenville County is the school district tax. For example in the. --Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050.

The median property tax on a 14810000 house is 155505 in the United States. The reader should not rely on the data provided herein for any reason. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value.

County functions supported by GIS include real estate tax assessment law enforcementcrime. Estimated Range of Property Tax Fees. South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median amount of property taxes collected.

The median property tax in Greensville County Virginia is 523 per year for a home worth the median value of 94600. The countys average effective rate is 069. Select a taxing district from the drop down list and the.

The median property tax on a 14810000 house is 97746 in Greenville County. Search for Real Property. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County. The median property tax on a 14810000 house is 97746 in Greenville County.

Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein. The median property tax also known as real estate tax in. If you disagree with the panels decision you can appeal to a state-level board or panel.

2022 Proposed Rates Tax Estimator Homestead portability is not factored into this calculation. Tax amount varies by county. Search for Voided Property Cards.

You can call the Greenville County Tax Assessors Office for assistance at 864-467-7300. The median property tax on a 14810000 house is 74050 in South Carolina. In case of litigation it may make sense to get help from one of the best property tax attorneys in Greenville County SC.

Get a Paid Property Tax Receipt for SCDNR Registration. Lexington County explicitly disclaims any representations and warranties including without. Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by.

You can also pay online. Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601. Greenville County collects on average 066 of a propertys assessed fair market value as property tax.

Welcome to the Greenville County Geographic Information Systems GIS homepage. Property Tax Estimator Notice The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Greenwood County Tax Estimator South Carolina SC.

Select Tax Year. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Additionally you will find links to contact information.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. You can pay your property tax bill at the Tax Collectors department. If you attempt to use the link below and are unsuccessful please try again at a later time.

Personal property returns cannot be filed electronically. Greensville County collects on average 055 of a propertys assessed fair market value as property tax. If you have documents to send you can fax them to the Greenville County assessors office at 864-467-7440.

If you are qualified to port any of your deferred value then your actual taxes will be lower than this estimate. Enter the Property Sale Price - 10000 Minimum Value no comma seperators Step 2. Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations.

Timothy Nanney Register of Deeds. Box 421270 129 Screven Street Georgetown SC 29442-4200 Phone. Greensville County has one of the lowest median property tax rates in the country with only two thousand three hundred sixty eight of the 3143 counties.

If your vehicle is improperly qualified or you are uncertain whether your vehicle would be eligible for car tax relief because it is used part of the time for business purposes contact the Greensville County Commissioner of the Revenues Office at 434-348-4227. For an estimation on county taxes please visit the Greenville county or Laurens county. County Home Page Search Services Legal Disclaimer.

South Carolina Property Tax Calculator Smartasset

Greenville Cost Of Living Greenville Sc Living Expenses Guide

9 Candidates File For 6 Seats On Greenville County Schools Board Of Trustees Greenville Journal

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

Ultimate Guide To Understanding South Carolina Property Taxes

Greenville County Council Candidates Answer Our Questions Bike Walk Greenville

South Carolina Property Tax Calculator Smartasset

South Carolina Property Tax Calculator Smartasset

Why Land Values Are Rising In Greenville County South Carolina

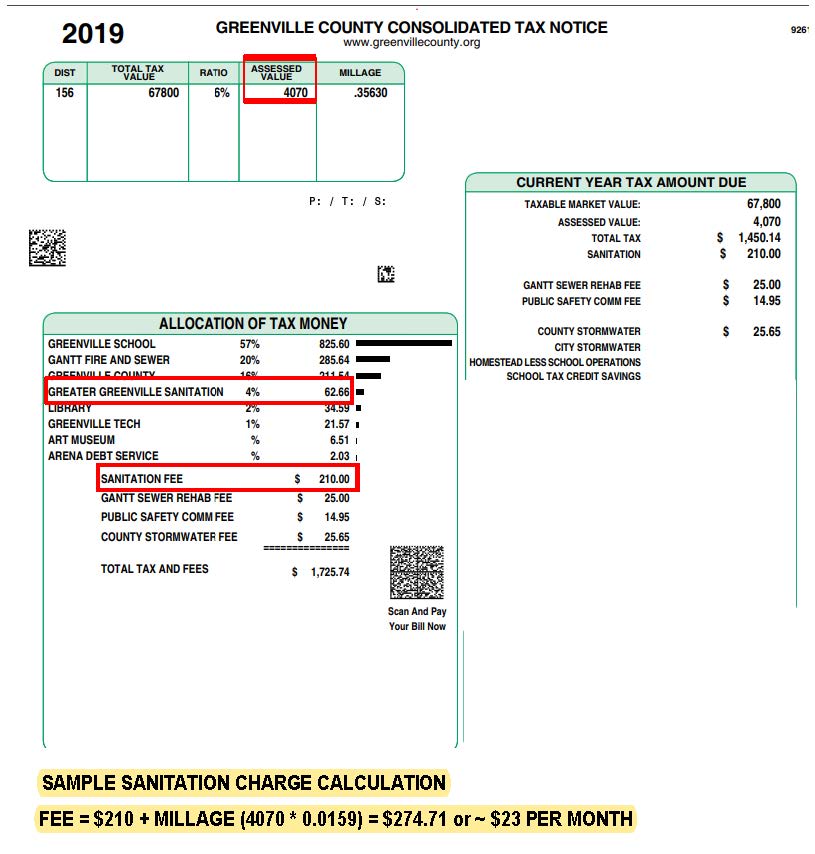

Fees Annexation Greater Greenville Sanitation

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

Greenville Sc Real Estate Market Stats Trends For 2022

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal

Tax Rates Hunt Tax Official Site

Greenville Sc Cost Of Living Is Greenville Affordable Data

17 Things To Know Before Moving To Greenville Sc

Greenville Cost Of Living Greenville Sc Living Expenses Guide